Custom Private Equity Asset Managers Can Be Fun For Anyone

Wiki Article

A Biased View of Custom Private Equity Asset Managers

(PE): investing in business that are not openly traded. Approximately $11 (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1701758819&direction=prev&page=last#lastPostAnchor). There may be a few points you don't understand regarding the sector.

Companions at PE firms raise funds and take care of the cash to produce positive returns for investors, usually with an investment perspective of in between 4 and 7 years. Personal equity firms have a variety of financial investment choices. Some are strict investors or passive investors wholly based on monitoring to grow the click to read more company and produce returns.

Since the ideal gravitate toward the larger offers, the center market is a considerably underserved market. There are more sellers than there are highly seasoned and well-positioned finance specialists with substantial purchaser networks and resources to manage a deal. The returns of personal equity are commonly seen after a couple of years.

The Ultimate Guide To Custom Private Equity Asset Managers

Flying below the radar of large multinational corporations, a number of these small firms often offer higher-quality customer care and/or niche services and products that are not being offered by the large empires (https://www.mixcloud.com/cpequityamtx/). Such advantages bring in the interest of private equity firms, as they have the understandings and savvy to manipulate such opportunities and take the business to the next level

Most managers at profile companies are offered equity and bonus offer settlement structures that award them for striking their monetary targets. Personal equity chances are usually out of reach for people that can not spend millions of bucks, yet they shouldn't be.

There are laws, such as restrictions on the accumulation amount of cash and on the number of non-accredited investors (Private Equity Firm in Texas).

Our Custom Private Equity Asset Managers Statements

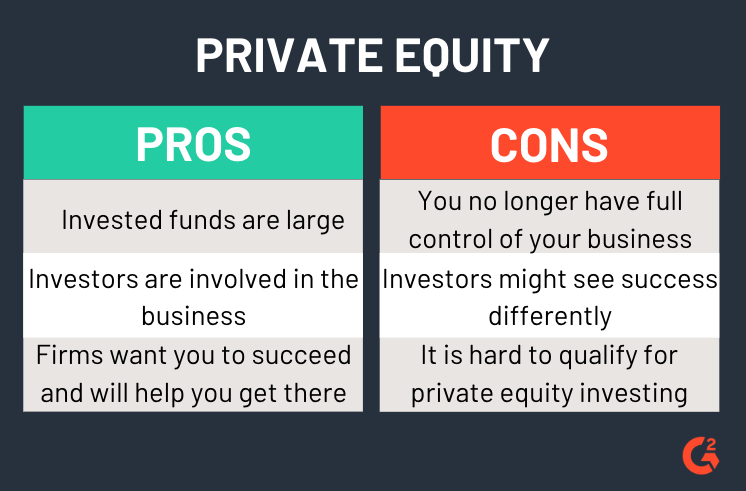

An additional negative aspect is the absence of liquidity; as soon as in a personal equity deal, it is hard to leave or market. There is a lack of adaptability. Private equity additionally comes with high charges. With funds under management already in the trillions, exclusive equity companies have become appealing financial investment lorries for rich individuals and establishments.

Now that access to personal equity is opening up to even more specific investors, the untapped potential is coming to be a fact. We'll start with the main arguments for investing in personal equity: Just how and why private equity returns have actually traditionally been higher than various other properties on a number of degrees, Just how consisting of personal equity in a portfolio affects the risk-return account, by assisting to diversify versus market and cyclical threat, Then, we will certainly detail some crucial considerations and dangers for personal equity financiers.

When it pertains to introducing a new possession into a portfolio, the a lot of basic factor to consider is the risk-return account of that property. Historically, private equity has shown returns comparable to that of Arising Market Equities and greater than all various other traditional asset classes. Its reasonably reduced volatility paired with its high returns makes for an engaging risk-return account.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

Exclusive equity fund quartiles have the widest array of returns throughout all alternative property courses - as you can see listed below. Technique: Inner rate of return (IRR) spreads out computed for funds within classic years independently and after that balanced out. Median IRR was determined bytaking the standard of the median IRR for funds within each vintage year.

The effect of including personal equity right into a portfolio is - as constantly - dependent on the profile itself. A Pantheon research study from 2015 recommended that including private equity in a profile of pure public equity can open 3.

On the various other hand, the very best exclusive equity companies have accessibility to an also bigger swimming pool of unknown possibilities that do not deal with the exact same examination, as well as the sources to execute due diligence on them and identify which are worth purchasing (Private Equity Platform Investment). Investing at the very beginning indicates higher threat, but also for the companies that do prosper, the fund benefits from higher returns

A Biased View of Custom Private Equity Asset Managers

Both public and exclusive equity fund managers commit to spending a portion of the fund however there continues to be a well-trodden issue with aligning passions for public equity fund management: the 'principal-agent problem'. When a financier (the 'major') employs a public fund supervisor to take control of their capital (as an 'agent') they pass on control to the manager while maintaining ownership of the assets.

In the situation of exclusive equity, the General Partner does not simply earn a monitoring cost. Exclusive equity funds likewise alleviate an additional form of principal-agent problem.

A public equity financier eventually wants something - for the management to raise the stock rate and/or pay dividends. The investor has little to no control over the choice. We showed over the amount of private equity approaches - specifically bulk buyouts - take control of the operating of the business, ensuring that the lasting worth of the company comes initially, raising the return on investment over the life of the fund.

Report this wiki page